Russia is an important global oil supplier but how was this aspect not addressed in these sanctions? Russia produces nearly $11 million barrels of crude oil per day. It uses roughly half of this output for its own internal demand, which is seemingly less comparative to the exports. However, it has increased due to higher military fuel demands, and exports about 5 million to 7 million barrels per day.

As per the reports, Russia is the second-largest crude oil producer in the world, followed by the U.S and ahead of Saudi Arabia.

These sanctions imposed on Russia earlier did not ban any Russian Oil Companies, and the reason is so evidently clear; Russia exported roughly 2.5 million oil barrels per day to the major European Countries — Germany, Italy, the Netherlands, Poland, Finland, Lithuania, Greece, Romania, and Bulgaria.

Russia is Minting Billion of Dollars per day through Crude Oil Exports

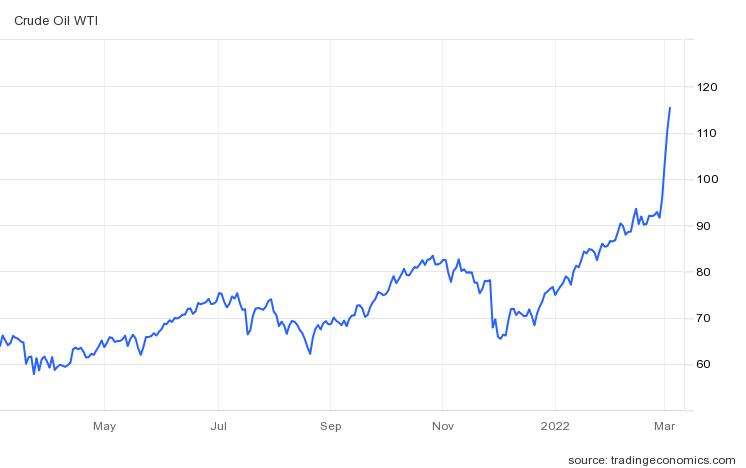

The oil prices surged beyond $110 per barrel on Wednesday as the traders legitimately scrambled to seek alternative oil sources due to supply disruptions after sanctions by Russian banks amid the Ukraine conflict, while U.S crude inventories fell quite unexpectedly, underscoring the already tight market.

The Brent crude futures hit their highest since 2014 at $113.94 a barrel, before easing at $109.85, which is nearly $4.88 or 4.7%.

The U.S West Texas Intermediate (WTI) crude futures jumped to nearly $9 to $112.51 a barrel, hitting the highest since 2011 before losing to trade up to $4.55, or 4.4%, at $107.96.

#EconWatch: The #oil futures market is in extreme backwardation: spot prices are well above futures prices. Backwardation that is this great tells us that, in the near term, the world is facing a severe shortage of crude oil. pic.twitter.com/hDlrC7TQ0M

— Steve Hanke (@steve_hanke) March 3, 2022

As per the reports, earlier today Washington DC made it clear that they may be “very open” to imposing sanctions on Russia’s oil and gas industry as it also weighs the potential market impact.

That they are still considering hitting Moscow’s vast energy sector over Russia’s invasion of Ukraine, and the impact on global oil markets and U.S. energy prices affect it would evidently have in the market.

White House spokeswoman Jen Psaki said,

“We’re very open. We’re considering it. It’s very much on the table, but we need to weigh what all of the impacts will be.”

How Would Sanctions on Oil Industry Affect Russia?

The President of Russia, Vladimir Putin, held talks on March 1 with Abu Dhabi’s Crown Prince, Mohammed bin Zayed to discuss OPEC+ strategy right before the oil cartel meeting to decide the output quotas as crude trades above $100/billion dollars against the backdrop of the Ukraine intensifying conflict.

The Kremlin addressed the matter in an official statement earlier today,

“The progress in implementing the OPEC+ agreement was discussed. The intention to continue coordination between the two countries in the interests of maintaining stability in the global energy market was emphasized.”

OPEC Kingpins Saudi Arabia and the UAE have avoided criticizing Russia’s actions, they also abstained from the UNSC vote to impose sanctions on Russia; however, the US along with its allies have hit the Kremlin with far-reaching financial sanctions.

As per the reports, OPEC+ is presumably sticking with its curated strategy of adding 400,000 billion of incremental output to major supply despite growing concerns among consumer nations over high prices.

Sanctions against Russia’s oil industry would rather have a greater impact than limiting natural gas flows because Russia’s oil receipts are higher and more critical to its state budget.

As per reports, Russia is minting over $110 billion dollars from oil exports, twice as much as its earnings from natural gas sales abroad.

Relatively oil is a fungible global commodity, much of Russia’s crude exports to Europe and other G-7 countries possibly might wind up being sent somewhere else. This proactive action would free up other supplies from sources such as Norway and Saudi Arabia to be redirected back to Europe.

As per the reports, Russia’s oil has high Sulfur and other impurities, so basically refining it requires specialized equipment and it cannot be sold just anywhere. But other Asian buyers are ready to purchase it, including India and Thailand. And Russia definitely has special supply arrangements with countries like Cuba and Venezuela.

As per the reports, Saudi Arabia has had instituted price wars that hurt Russia’s economy in 1986, 1998, 2009, and 2020, but refused to wage-price war earlier today amid the Ukraine conflict as they abstained from the UNSC vote as well. But today’s oil market conditions make a price war an unlikely outcome, possibly because of the existing tight balance between supply and demand.

Even if the U.S and EU collectively rush in with their reserves to drop Russia’s oil price value in the market, given that Russia is a major supplier; this collective effort would only last 12 days and they must resort to an alternative supplier.

The only scenario that could possibly trigger a price war now would be if global demand were to suddenly contract because of a recession.

Also Read: De-Dollarization: How Russia Minimized the Impact of the Sanctions Imposed by the U.S and EU